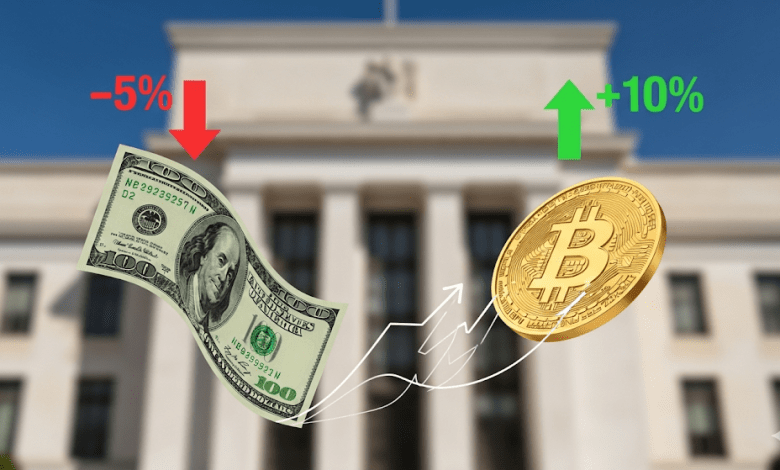

Fed’s Third Mandate Could Boost Crypto and Weaken Dollar

A “third mandate” from the U.S. Federal Reserve could change long-term money rules, possibly making the dollar weaker and helping cryptocurrencies grow. The Fed usually has two goals: keep prices stable and help people get jobs.

But the 1913 Federal Reserve Act also has a third goal: keep long-term interest rates moderate. Stephen Miran, chosen by President Trump as a Fed governor, spoke about this third mandate earlier this month.

This made people wonder how the Fed might act in the future. Bloomberg reported that the Trump team may use this rule to justify more active steps in the money market, including buying government bonds or printing more money.

The Trump administration wants the Fed to take stronger actions to lower long-term interest rates. Lower rates mean the government can borrow money cheaper, especially with the national debt at $37.5 trillion. It could also make mortgages cheaper for people buying homes.

Trump has said Fed governor Jerome Powell is “too slow” in cutting rates. Officials might try different tools, like issuing more Treasury bills, buying back government bonds, or directly controlling interest rates. These actions aim to make money cheaper and help the economy grow faster.

Some experts in cryptocurrency say this is good news for crypto. Christian Pusateri, founder of Mind Network, said, “The price of money is coming under tighter control because the age-old balance between capital and labor, between debt and GDP, has become unstable.” He added, “Bitcoin stands to absorb massive capital as the preferred hedge against the global financial system.”

Arthur Hayes, founder of BitMEX, also said this could be bullish for crypto and suggested that controlling interest rates might even push Bitcoin to $1 million.

The third mandate has mostly been ignored for many years. Most people thought it was already covered by the first two goals. Now, the Trump team says it gives the Fed legal permission to act more aggressively in markets.

The rule in the 1913 Federal Reserve Act says the Fed should aim for three things: stable prices, full employment, and moderate long-term rates. If this third mandate is used, it could change both regular money markets and digital currencies, affecting investors everywhere.

Also Read: Santander’s Openbank Rolls Out Crypto Trading in Germany