Cboe to Launch Continuous Bitcoin and Ether Futures in U.S.

Cboe Global Markets said it will launch new “continuous futures” contracts for Bitcoin and Ether on November 10, 2025.

According to the press release, it still needs approval from U.S. regulators, but if cleared, it will bring a very popular trading product from overseas markets into the United States.

Cboe is a big exchange that operates under the Chicago Board Options Exchange. It explained that these new contracts will last 10 years, which is much longer than normal futures contracts that usually last only a few months.

Because of this, traders will not need to keep renewing or “rolling over” their positions. Rolling over is when traders have to close one contract and open a new one as it expires. This new setup makes trading simpler and less costly.

How Continuous Futures Work

The new contracts are designed to work like perpetual contracts. Perpetual contracts are very common in decentralized finance, also known as DeFi, and on offshore exchanges. They do not have an end date, so traders can keep their positions open for as long as they want. Cboe’s continuous futures are not exactly the same, since they will expire after 10 years, but they follow the same idea of making trading easier and longer-lasting.

These contracts will also be cash-settled. This means that traders will not receive actual Bitcoin or Ether when the contract ends. Instead, they will get paid or owe money based on the price of the cryptocurrency in the market. The price will be tied to the real market value, which Cboe says will be done with transparent funding methods.

“Perpetual-style futures have gained strong adoption in offshore markets. Now, Cboe is bringing that same utility to our US-regulated futures exchange,” said Catherine Clay, global head of derivatives at Cboe.

At the time of the announcement, Bitcoin was priced at $111,763 and Ether at $4,312. These numbers show the size and importance of the two assets that Cboe is targeting with the new contracts.

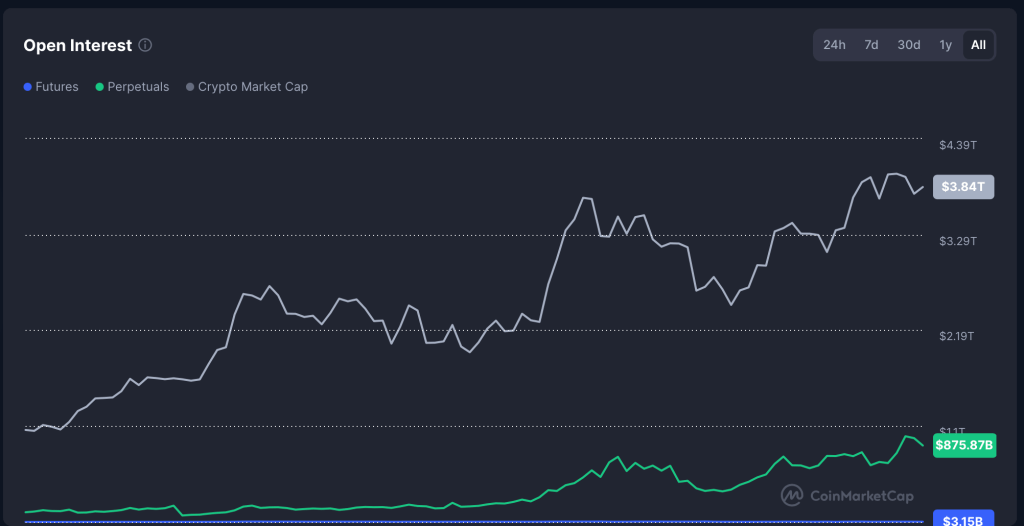

Research firm Kaiko said that perpetual futures already make up 68% of Bitcoin’s total trading volume in 2025. The total open interest, or the number of contracts still active, has reached $876 billion across all perpetual futures.

Cboe first introduced Bitcoin futures in 2017 but later stepped back. With new rules and friendlier regulators under the Trump administration, Cboe is now returning to crypto with a product that looks more like what traders already use overseas. Earlier this year, Bitnomial launched the first U.S. perpetual futures in April, and Coinbase introduced smaller “nano” perpetual contracts in July.

Also Read: DC Attorney General Sues Athena Bitcoin Over Crypto ATM Scams