The Crypto Market Is Down Today, Here’s Why

The crypto market crashed hard on yesterday, September 22, as Bitcoin fell under the key $115,000 mark. This fall wiped about $77 billion from the total market value in just one day. Right now, the overall market is valued at $3.91 trillion, which is far from its recent highs.

Bitcoin and Altcoin Market Drops Down in Value

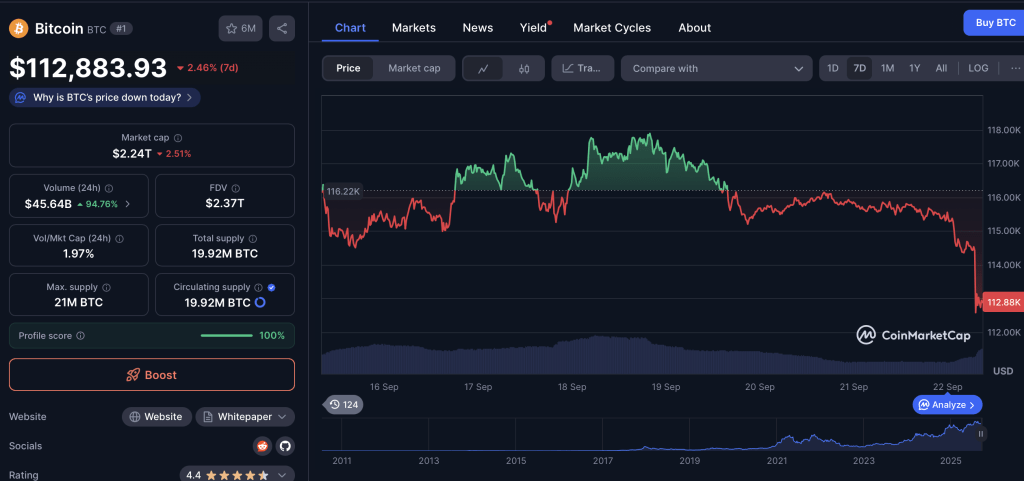

At the time of writing this report, Bitcoin is trading for $113,031 after losing 2.38% over the weekend. There was followed by an 89% surge in trading activity which suggests that traders and investors are taking profits from the market.

Ethereum, the second largest cryptocurrency by market cap, also dropped by 8.64% and now trades for $4,201, while Dogecoin crashed by 7.1% as traders rushed to sell. Solana and other coins were hit too, according to CoinMarketCap as the selling pressure spread across the entire market.

$1.70 Billion Liquidated In 24 Hours

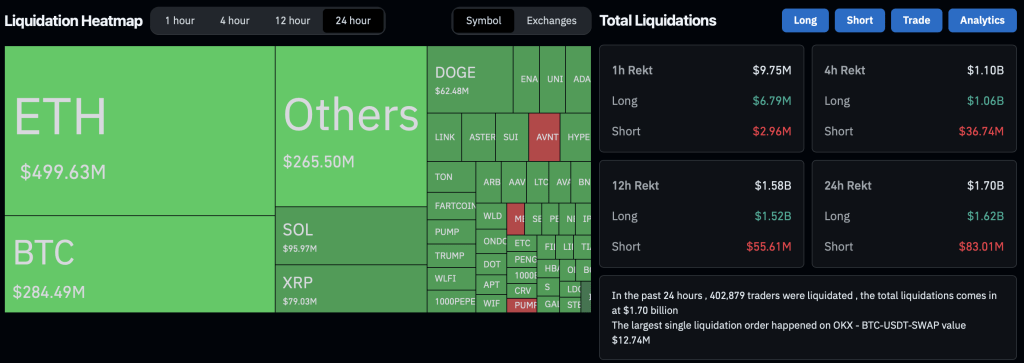

Meanwhile, a lot of traders, about 406,613, got liquidated from their positions in the last 24 hours because of the heavy fall. According to Coinglass, the total amount liquidated resulted in a massive $1.70 billion.

Ethereum saw the biggest liquidations, followed by Bitcoin. One Bitcoin trader lost $12 million in a single liquidation. These forced sales often push prices down even further because they flood the market with more coins for sale.

What the Charts Are Saying

Currently, the Crypto Fear & Greed Index is at 45, which means investors are not too scared but also not excited. Analysts say the next support to watch for the overall crypto market cap is $3.73 trillion. If prices break below that, the selling could get worse. On the other hand, if it holds, the market could recover toward $3.94 trillion and possibly test the $4 trillion mark again. For Bitcoin, the next key level is $110,000, while going back above $115,000 is needed to calm traders

Why Investors Are Selling

Moreover, the U.S. Federal Reserve also played a role in this drop. Last week, the Fed cut interest rates by 0.25%, which usually helps risky assets like crypto. At first, prices went up, but then traders started to “sell the news,” which is common after big events.

Now, they are waiting for the next opportunity to buy the market. Meanwhile, U.S. Bitcoin ETFs still saw $163 million in inflows, and Japanese firm Metaplanet bought $633 million worth of Bitcoin, which raised its total holdings to 25,555 BTC.

Still, global markets are turning cautious as central banks show less support for risk, while U.S. states like Michigan are pushing forward with pro-crypto laws.

Also Read: REX-Osprey XRP ETF Hits $37.7M on Record First Day