Alibaba Plans Tokenized Payments With JPMorgan For B2B

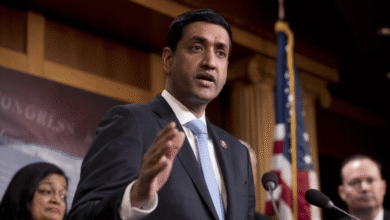

Alibaba’s cross-border e-commerce arm announced on Friday it plans to use tokenized payments to speed up global business transactions. In an interview with CNBC, Kuo Zhang, president of Alibaba.com, said the company will work with JPMorgan to test the system.

This aims to help international buyers and suppliers complete payments more quickly and smoothly. In addition, Alibaba also launched an AI subscription service called AI Mode to help businesses compare suppliers more easily.

AI Mode allows buyers to check suppliers on pricing, shipping options, and production capacity in one place. Zhang told CNBC, “We feel the urgency that we need to use AI to redesign how people do global trade.”

As a result, the tool is designed to save time and reduce errors in comparing suppliers across countries. Alibaba is considering charging $20 per month or $99 per year for the service, though final pricing has not been decided.

Meanwhile, the tokenized payment system uses digital versions of dollars and euros to make transfers faster. Normally, cross-border payments go through multiple banks and can take several days.

With tokenized money, funds can move directly between buyers and suppliers using blockchain technology. Zhang explained, “So when the U.S. buyers or euro buyers pay certain amount of euros, it doesn’t need to go around different banks around the world.”

Furthermore, Alibaba plans to launch another AI feature called Agentic Pay in December. This tool can turn buyer-supplier conversations into contracts automatically. Both sides can review and approve contracts without extra steps. Zhang said the tool aims to simplify a process that is often slow and confusing.

Notably, Alibaba.com generated over $3 billion in revenue last fiscal year. In addition, the platform’s active supplier count grew 50% from March to October compared to last year. Alibaba’s B2B business remains smaller than its domestic e-commerce and cloud divisions but is one of its fastest-growing units.

That said, Zhang mentioned Alibaba will consider using stablecoins in the future. The company wants to gain experience with tokenized payments before exploring other digital currencies.

With these moves, Alibaba hopes to make global trade faster, smarter, and more efficient for businesses everywhere.

Also Read: Czech Central Bank Starts $1M Digital Asset Test Portfolio