ARK Invest Buys $8.2M in Bullish Shares After IPO Drop

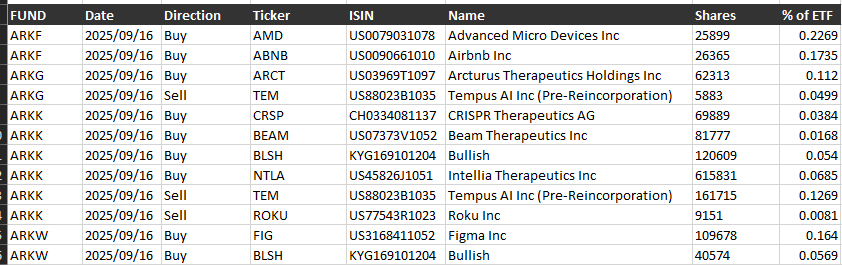

Cathie Wood’s ARK Invest has bought over 160,000 shares of the crypto exchange Bullish, spending about $8.21 million. The purchase was made through two of its funds, the ARK Innovation ETF (ARKK) and the ARK Next Generation Internet ETF (ARKW), according to a filing on Tuesday.

With this buy, ARK now owns more than $129 million of Bullish shares across ARKK, ARKW, and the ARK Fintech Innovation ETF (ARKF). ARK first bought Bullish shares when the company listed on the New York Stock Exchange last month, picking up 2.53 million shares worth $172 million.

The company is buying more Bullish shares to rebuild its position after the stock price dropped. Earlier this month, ARK spent $7.5 million on Bullish, and in late August it bought $21 million more.

Now, ARK owns 2.52 million Bullish shares in total, which shows it sold some shares before but is buying again after the price fell. When Bullish first listed, the stock jumped to $118 during the day, a 218% rise from its $37 IPO price. But the price has since fallen and closed Tuesday at $51.36, almost 57% below its highest point, according to Google Finance.

Bullish said its revenue fell slightly, by 0.2%, in the quarter ending March, while its operating income dropped 270% in the same period. The exchange will release its second-quarter results on Thursday, which will be its first earnings report since going public.

Analysts have different views on Bullish. Jefferies gave a “hold” rating, JP Morgan and Bernstein gave “neutral” ratings, and Cantor Fitzgerald gave an “overweight” rating, expecting the stock to do better.

ARK Invest has also been buying other crypto stocks. On September 9, it spent $4.4 million on BitMine shares, bringing its total to 6.7 million shares worth $284 million. The company also owns $193 million of Block shares, a financial company backed by Jack Dorsey, as of August 12.

Also Read: Fed’s Third Mandate Could Boost Crypto and Weaken Dollar