Australia Leads the World in Crypto Interest, New Data Shows

Australia has emerged as the global leader in cryptocurrency interest per capita, according to new data from Andreessen Horowitz’s crypto division. The report found that most of the country’s online crypto activity is focused on trading and speculation.

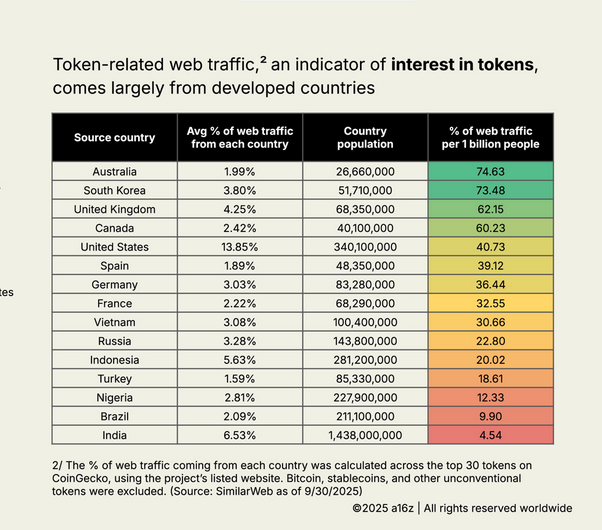

The study analysed web traffic across the top 30 crypto tokens on CoinGecko, excluding Bitcoin and stablecoins. When measured by population, Australia recorded the highest token-related web traffic at 74.63% per 1 billion people, followed by South Korea with 73.48%, and the United Kingdom with 62.15%. The United States ranked lower, with only 40.73% of its web traffic linked to token activity.

The report also noted a clear difference in user behaviour between developed and developing countries. The people who use cryptocurrencies in developed countries like Australia and the UK mainly focus on trading and speculative activities. People in developing countries use cryptocurrencies for mobile wallet services and other on-chain operations.

Industry projections suggest that Australia’s growing interest in crypto will continue. Statista data shows the country will experience a 19.85% annual growth rate in its cryptocurrency market which should hit AUD 1.2 billion (USD 780 million) by 2026. The number of users is expected to grow to 11.16 million, representing nearly 41% of the population.

Swyftx conducted an independent survey, which revealed that 40% of Australian Gen Z and Millennial participants expressed regret about their delayed cryptocurrency investments. The market shows ongoing interest from younger investors who watch it develop.

A study of 3,009 people found 40% of under-35 regret not investing in crypto ten years ago. Source: Swyfx

Australia actively develops its crypto industry through growing market adoption and expanding market size which positions the country as a leading global destination for digital currency activities.

Also Read: Bitcoin Miners’ Debt Soars 500% Amid AI Expansion