Bitcoin Leads $921M Inflows as Rate Cut Hopes Rise

Digital asset funds saw a sharp rebound last week as investors poured $921 million into crypto products. The jump came after lower-than-expected U.S. inflation data boosted hopes for more interest rate cuts this year.

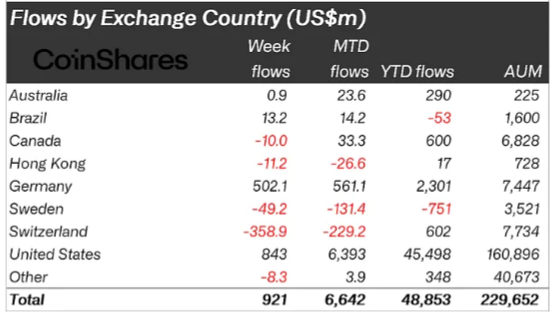

According to the CoinShares report released on October 27, most of the buying came from the United States and Germany, while Switzerland saw outflows caused by asset transfers, not selling.

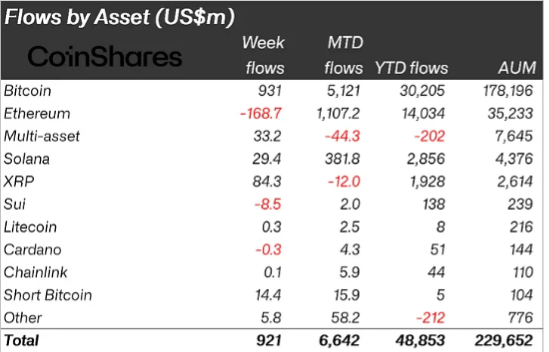

Bitcoin led the surge with $931 million in inflows. Its total inflows since the Federal Reserve began cutting rates have now reached $9.4 billion. Year-to-date inflows stand at $30.2 billion, still below last year’s $41.6 billion.

Flows by Asset | source: Coinshare

Ethereum, on the other hand, saw $169 million in outflows, marking its first weekly decline in five weeks. Even so, CoinShares noted that leveraged Ethereum products remain popular among traders.

Additionally, trading volumes stayed high at $39 billion for the week, above the yearly average of $28 billion. The U.S. led with $843 million in inflows, followed by Germany with $502 million, one of its biggest weeks ever..

Switzerland, however, recorded $359 million in outflows due to internal fund transfers. Furthermore, the report mentioned that the ongoing U.S. government shutdown has slowed key economic updates, leaving investors uncertain about policy direction. Nevertheless, the CPI data helped lift confidence across markets.

Flow by Exchange Country | Source: Coinshare

At the same time, Altcoin inflows cooled. Solana saw $29.4 million after setting records earlier this month, while XRP recorded $84.3 million, down from previous highs. Cardano slipped into $0.3 million outflows, and Sui and Litecoin also lost investor interest.

CoinShares said the slowdown in these tokens is linked to delays in the U.S. SEC’s ETF decisions caused by the prolonged shutdown.

As a result, the total assets under management rose to $229.65 billion as Bitcoin rebounded above $116,000. Ethereum traded near $4,200 but faced profit-taking from large holders. Finally, the report added that traders expect another 25 basis point rate cut soon, which could bring more market swings.

Also Read: Ripple Launches Ripple Prime After $1.25B Hidden Road Deal