Bitcoin Miners’ Debt Soars 500% Amid AI Expansion

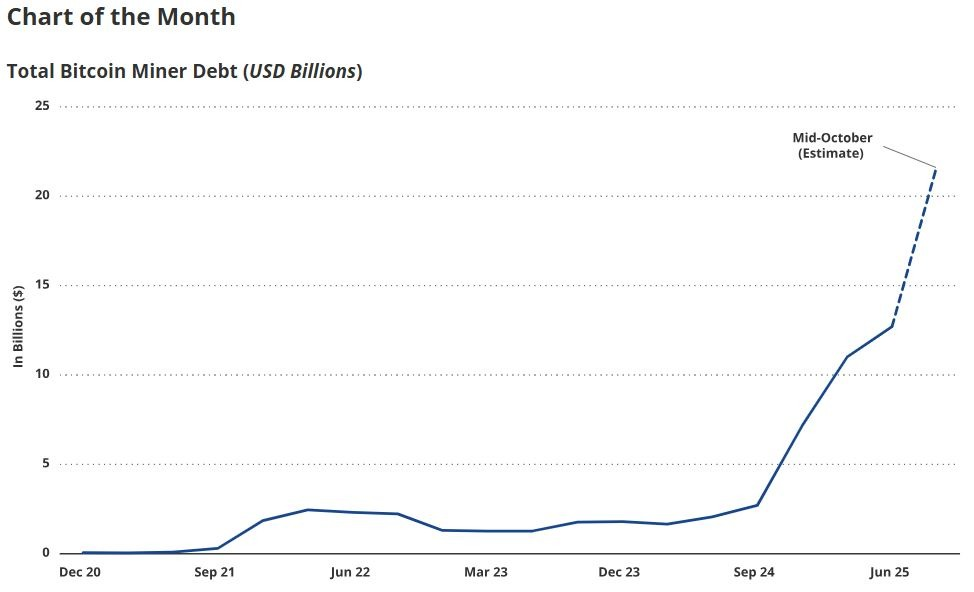

According to investment firm VanEck, debt among Bitcoin miners has surged from $2.1 billion to $12.7 billion within a year as companies rush to invest in artificial intelligence (AI) and new mining equipment.

Bitcoin miners dept increases from $2.1 billion to $12.7 billion in the last 12 months. Source: VanEck

VanEck analysts Nathan Frankovitz and Matthew Sigel explained that miners must keep upgrading to the latest machines to maintain their share of the global hashrate, the computing power that secures the Bitcoin network and determines mining rewards.

“If miners stop investing in new equipment, their share of the global hashrate deteriorates, leading to fewer Bitcoin rewards,” Frankovitz and Sigel said in VanEck’s October Bitcoin ChainCheck report. “We refer to this dynamic as the melting ice cube problem.”

Traditionally, miners relied on equity financing to fund equipment purchases, but many have now turned to debt as they diversify into AI and high-performance computing (HPC). The analysts noted that AI-related services offer “more predictable cash flows backed by multi-year contracts,” which makes borrowing easier and cheaper than equity.

The Miner Mag data shows that public miners issued around $4.6 billion in debt and convertible notes in the fourth quarter of 2024, followed by $200 million at the start of 2025 and $1.5 billion in the second quarter of the year.

After the April 2024 Bitcoin halving, which reduced mining rewards to 3.125 BTC per block, many miners started using part of their energy capacity for AI and HPC hosting to offset declining profits.

Firms like Bitfarms, TeraWulf, and IREN have since raised billions in convertible notes to finance AI-focused data centre expansion.

VanEck’s analysts said this shift does not pose a threat to Bitcoin’s network security. Instead, they believe AI demand for energy supports the industry. “AI’s priority for electrons is a net benefit to Bitcoin,” they wrote.

Some miners are also testing ways to monetize excess electricity during low AI demand periods, a move that could reduce costs tied to backup power sources and improve overall efficiency in the long term.

Also Read: Quantum Solutions Becomes Japan’s Largest Ether Treasury with $9M Accumulation