BitMine Boosts Ethereum Holdings to $10.8B As Stock Soars

BitMine Immersion Technologies has raised its Ethereum treasury to $10.8 billion after adding 82,000 ETH in a week, lifting its total holdings to 2.151 million ETH. The announcement came on September 15 in Las Vegas, showing how the company is pushing toward its goal of owning five percent of Ethereum’s supply.

Chairman Thomas “Tom” Lee said the move reflects confidence in Ethereum’s future as finance shifts toward blockchain, comparing the moment to the end of Bretton Woods in 1971.

The latest purchase boosted BitMine’s treasury by $1.87 billion from last week, when its Ethereum stash was valued at $8.9 billion. Along with Ethereum, BitMine holds 192 Bitcoin, a $214 million stake in Eightco, and $569 million in cash reserves.

Its position makes it the largest Ethereum treasury worldwide and the second largest overall crypto treasury behind Strategy Inc, which holds 638,460 Bitcoin valued at $74 billion.

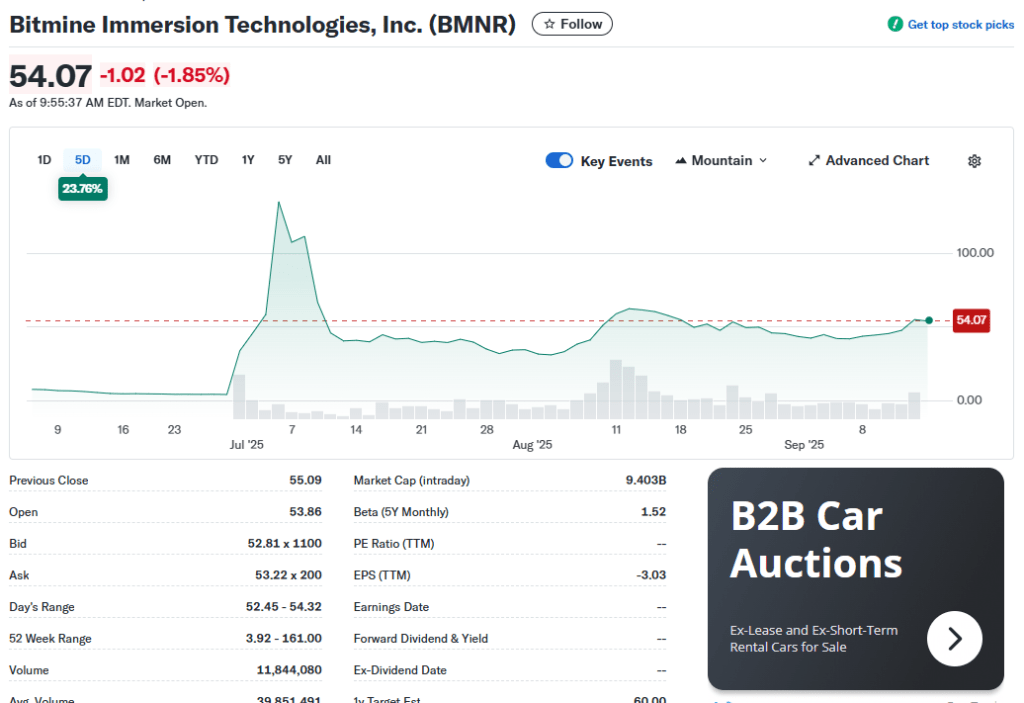

BitMine’s stock has rallied alongside its accumulation strategy. BMNR shares closed at $54.07, down 1.85% in one day, However, it has gained over 23% across five days. The stock is now the 28th most traded in the United States with daily turnover of $2 billion, a ranking that places it ahead of Arista Networks and just behind Eli Lilly.

BMNR Price action | Source: Yahoo Finance

Institutional backing has also played a role. Investors include ARK’s Cathie Wood, Founders Fund, Pantera, Galaxy Digital, Bill Miller III, Kraken, DCG, and personal commitments from Lee himself.

“We continue to believe Ethereum is one of the biggest macro trades over the next 10–15 years,” Lee said in the press release. “Wall Street and AI moving onto the blockchain should lead to a greater transformation of today’s financial system.”

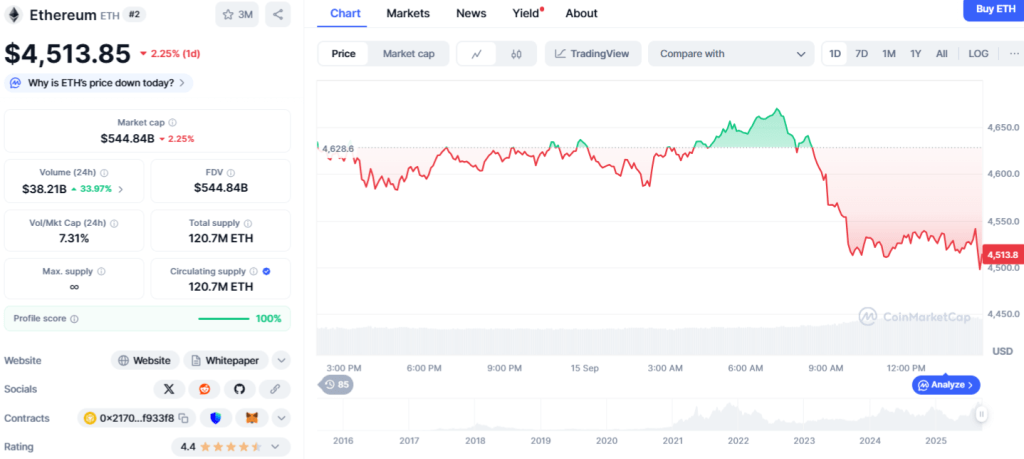

Notably, Ethereum’s market price stood at $4,513, down 2% on the day but higher across the week and month. Earlier in the session the token reached $4,619 before easing back, according to CoinMarketCap.

ETH Price action | Source: CoinMarketCap

That said, BitMine’s growing exposure means that a $100 change in Ethereum’s price will shift the company’s treasury value by more than $200 million, underscoring its scale in the market.

Also Read: France Threatens to Block EU Crypto License Passporting