BitMine Expands Eth Holdings with $417 Million Purchase Despite Market Volatility

According to Lookonchain’s data, BitMine Technologies acquires another 104,336 ETH for around $417 million in just seven hours. Three newly made wallets were used to conduct the transactions, and the tokens used were purportedly obtained from the BitGo and Kraken markets.

Prior to this move, the company’s earlier $828 million purchase last week highlighting BitMine’s consistent buying strategy despite ongoing market fluctuations. The company continues to use price dips to grow its holdings and reinforce its position in the Ethereum market.

BitMine Chairman Thomas Lee said the firm took advantage of the recent decline in Ethereum’s price.

“The crypto liquidation over the past few days created a price decline in ETH, which BitMine took advantage of,” he said. Lee added that “volatility creates deleveraging and this can cause assets to trade at substantial discounts to fundamentals,” suggesting that BitMine views these market drops as opportunities to buy at lower prices.

With these new purchases, BitMine now holds more than 3 million ETH, making it a total of 2.5% of Ethereum’s total supply. The company has also set a target of owning 5% of all ETH in circulation. After last week’s market dip, wallets linked to BitMine bought an additional 128,718 ETH, valued at approximately $480 million, from Kraken and FalconX. Lookonchain further noted 43,843 ETH in withdrawals tied to BitMine, showing a strong and ongoing accumulation trend.

Market analysts note that institutional interest in Ethereum is on the rise. Data from Bitwise shows that most Ethereum held by public companies was acquired in the past three months. According to the Strategic ETH Reserve, public firms now hold about 5.90 million ETH, valued at around $23.72 billion.

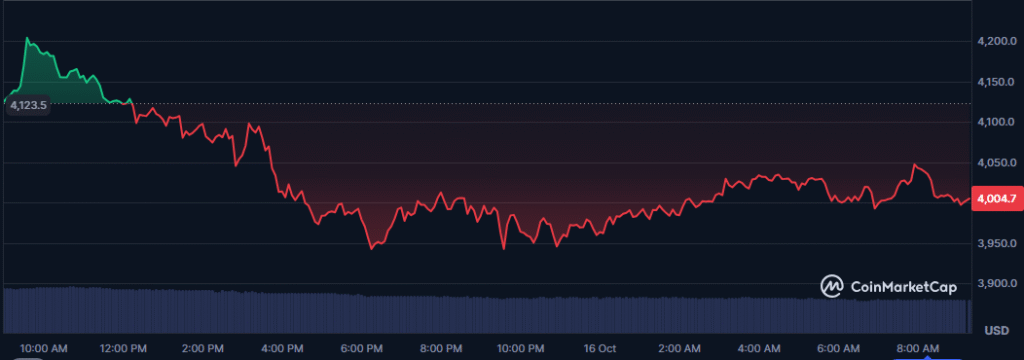

At the time of reporting, Ethereum trades at $4,005, down 2.49% in the past 24 hours, with over $46 billion in trading volume, according to CoinMarketCap.

Ethereum price trades below 5k and down by 2.49%| Source: CoinMarketCap.

Meanwhile, Yahoo Finance data shows that BitMine’s stock closed at $53.80, up 1.66% during the day, but fell slightly after trading hours.

Also Read: Bitcoin Faces Pressure Below $117K as Analysts Warn of Possible Correction