BlackRock Ethereum ETF Hits Record $359M Inflows

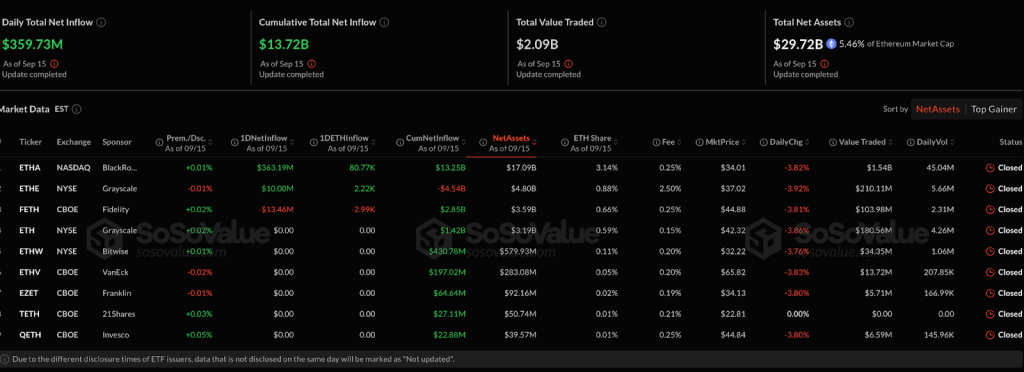

BlackRock’s Ethereum ETF (ETHA) pulled in a record 80,768 ETH, worth about $359 million, on September 15, 2025. This is the largest inflow the fund has seen in a month, according to SoSoValue. Meanwhile, this was after the fund lost a lot of money in the previous week.

The inflow pushed trading in ETHA to $1.5 billion in one day. Between September 5 and 12, the fund had $787 million in net outflows, which caused a bigger drop in the cryptocurrency market.

Last week, Ethereum funds started to recover, collecting $638 million in total. Fidelity’s FETH led with $381 million in new money, while BlackRock’s ETHA added $165 million. Other funds like Grayscale’s ETHE and Bitwise’s ETHW also saw smaller inflows, showing steady demand from big investors.

By September 12, Ethereum ETFs managed $30.35 billion in total. BlackRock had the largest share with $17.25 billion, which is about 3% of Ethereum’s total market value. The company moved some money from ETH to Bitcoin, as its iShares Bitcoin Trust (IBIT) received $366 million while ETHA had $17.3 million in outflows.

This suggests that BlackRock is shifting money between the two biggest cryptocurrencies. Even with the inflows, Ethereum’s price dropped 2.5% in one day. Market indicators like MACD and RSI suggest the price may stay around the same level, with $4,400 acting as a major support point.

Moreover, Ethereum’s network keeps growing. The total supply of stablecoins on Ethereum reached a record $166 billion. This shows the network is still very important for decentralized finance, even when prices go down. BlackRock is also planning to put ETFs on the blockchain, including products tied to real-world assets.

Also Read: France Threatens to Block EU Crypto License Passporting