Bullish Shares Jump as It Reports $57M Q2 Revenue

Crypto exchange Bullish reported its first quarterly earnings as a public company on Wednesday, surprising investors by beating Wall Street expectations with strong revenue and profit numbers. CEO Tom Farley announced the Q2 figures, which cover the period ending June 30, 2025.

The report revealed $57 million in revenue, slightly above analyst predictions of $55.75 million, while earnings per share came in at 93 cents, a big jump from the expected negative 6 cents, according to Zacks. The company’s net income also swung dramatically, posting $108.3 million, compared to a loss of $116.4 million during the same quarter last year.

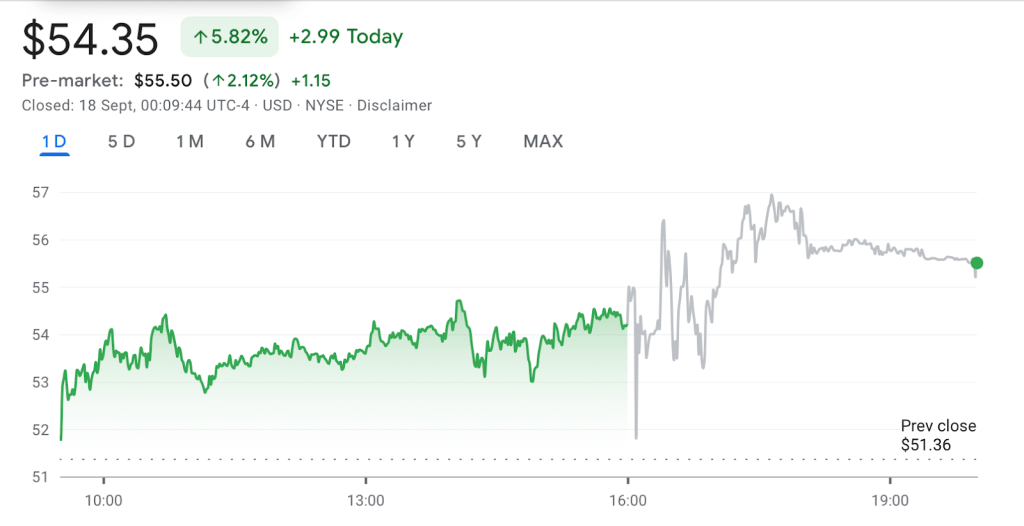

After the earnings release, Bullish’s shares gained 2% in after-hours trading, closing at $55.50. The increase followed a day that saw the stock rise 5.8% after the exchange announced it had received a BitLicense from New York financial regulators, which allows the platform to offer its services legally in the state.

Bullish went public in mid-August on the New York Stock Exchange, debuting at $37 per share. The stock initially surged to $68 but later dropped over 20% from that peak. Despite this decline, the share price is still 47% above the IPO level, showing that investors remain interested in the company.

The company also reported that its crypto sales for Q2 grew 18% year-on-year to $58.6 billion, and its trading volume climbed 35% to $179.6 billion. CEO Tom Farley said, “We’re excited that the work we did in the second quarter is already directly contributing to strong business momentum in the third quarter and beyond.”

Looking ahead, Bullish expects adjusted earnings before interest and taxes for Q3 to range from $25 million to $28 million, while net income is projected between $12 million and $17 million. The platform’s trading volume is expected to slow slightly to between $133 billion and $142 billion, even after Bitcoin and Ether recently hit record highs.

Bullish is also preparing for the full launch of its options trading platform in the fourth quarter, which is currently operating in a limited phase with selected clients. The company was one of the most anticipated crypto IPOs of the year, joining other high-profile public crypto firms such as Circle Internet Group, Gemini, and eToro.

Also Read: Bitget Marks 7 Years with Launch of Universal Exchange Era