Circle to Launch Native USDC on Hyperliquid with CCTP v2

Circle will soon launch native USDC on Hyperliquid, using its upgraded Cross-Chain Transfer Protocol (CCTP v2). The move allows users to move USDC across blockchains without wrapped tokens or bridges. The integration will happen on Hyperliquid’s HyperEVM, though no exact date has been shared yet.

In a blog post, Circle said the upgrade will let developers create apps for swaps, onboarding, and treasury tools using native USDC. Users on Hyperliquid will also be able to trade with USDC in spot markets and perpetual contracts. “Native USDC and CCTP v2 are coming soon to Hyperliquid,” the post announced.

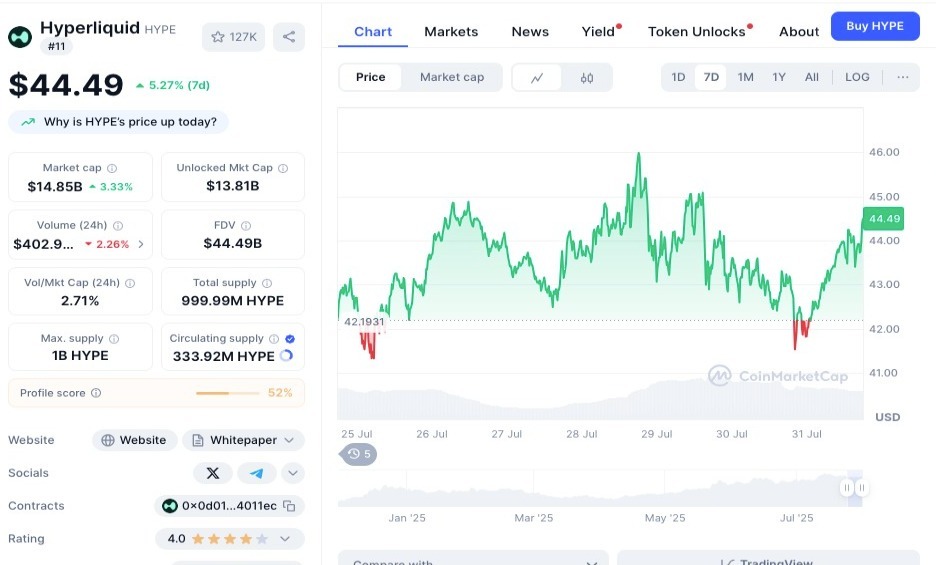

Hyperliquid is a decentralized exchange with fast-growing user activity and asset flows. In July, the platform’s AUM jumped to $5.5 billion, while its open interest crossed $10.6 billion. HYPE, Hyperliquid’s native token, rose 3% to $43.89 following the news, according to CoinMarketCap.

Hyperliquid users currently use USDC via Arbitrum, as native support was missing. This required an extra transfer step for traders. Arbitrum-based USDC on the platform surged from $4 billion to $5.5 billion this month, with $1.2 billion added to the DEX.

Notably, Hyperliquid combines two layers: HyperCore, its native DEX engine, and HyperEVM, which supports smart contracts. Circle’s new launch will be on HyperEVM, making USDC available across the entire Hyperliquid ecosystem.

This launch continues Circle’s busy summer of partnerships and integrations. In mid-July, the company teamed up with Ant Group to explore USDC use cases. In June, it integrated with World Chain and brought USDC to the XRP Ledger.

Meanwhile, Hyperliquid also teamed up with Phantom to expand into the Solana network, enabling in-wallet leveraged trading, as the platform continues to grow into a major player in DeFi.

At the time of writing, HYPE is trading for $44.49, a 5% increase in the last 24h, with a total market cap of 14.85B.

Also Read: Nano Labs Invests $5M in CEA to Boost BNB Reserve Strategy