Crypto Community Blames Binance, Trump, Wintermute for $500B Crash

The largest-ever crypto market crash wiped out over $500 billion in total market value on October 11, causing nearly $20 billion in liquidations of top digital assets. Consequently, the community is pointing fingers at the Binance exchange, market maker Wintermute, and US President Donald Trump for the sudden, sharp drop.

The crash saw Bitcoin plummet to a low of $104,582, and Ethereum dropped to $3,460, resulting in massive losses for traders globally. Many people now blame Binance-linked market maker Wintermute for contributing to the volatility.

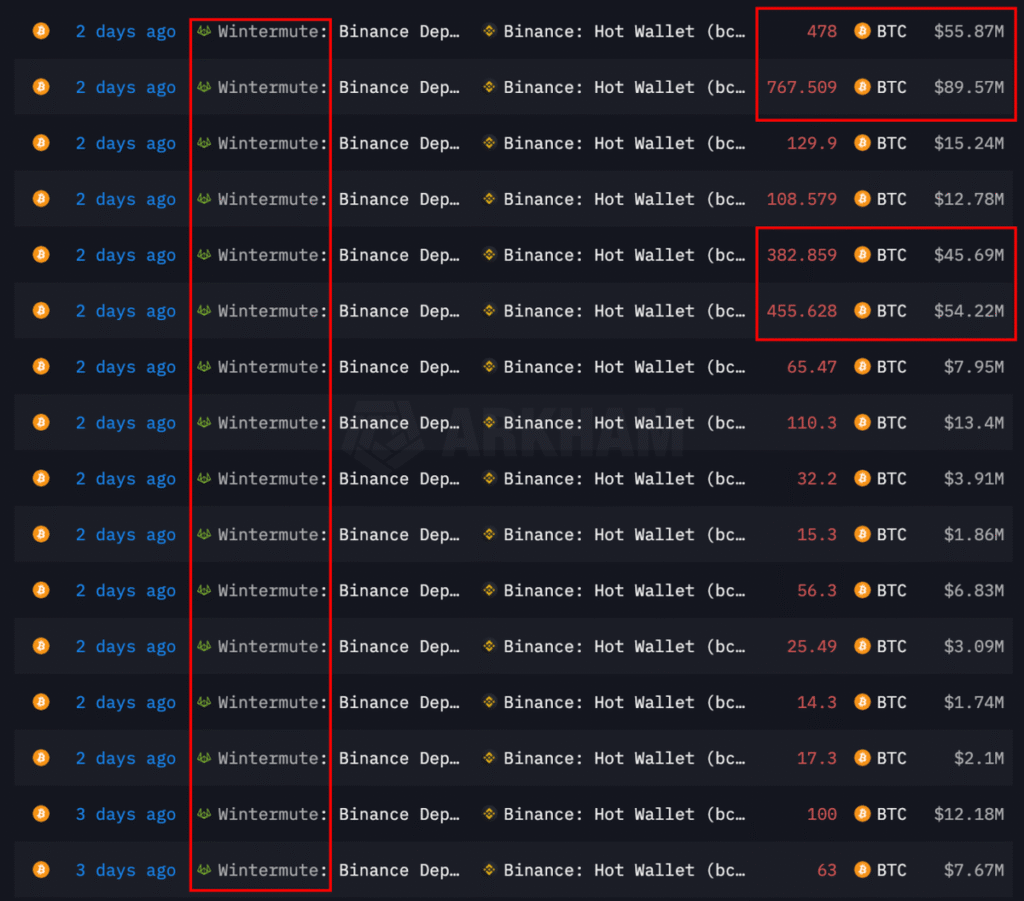

Before the market fell, Wintermute reportedly sent over $700 million to a Binance hot wallet. This action made the crypto community accuse the market maker of manipulation again. Notably, Wintermute had faced similar accusations in September after transfers to the firm preceded a $1.7 billion liquidation event.

One analyst, EveryCryptoTool’s Hanzo, observed that Binance’s order books went empty during the drop, lacking bids or walls, which caused a free fall.

Hanzo claimed, “Binance just reminded everyone who really runs this market, this crash wasn’t about Trump, tariffs, or macro, that was noise, the real story happened inside the books.” Wintermute allegedly stopped supporting the price by pulling its liquidity.

Wintermute Deposit to Binance | Source: Hanzo

Meanwhile, Binance users reported that the platform failed them, as stop orders froze and limit orders got stuck while only liquidations were processed.

The exchange faced additional claims that the crash resulted from a targeted attack. Uphold head of research, Martin Hiesboeck, said attackers exploited a flaw in Binance’s Unified Account margin system.

The flaw involved using assets like USDe, wBETH, and BNSOL as collateral because liquidation prices depended on Binance’s volatile spot market. Hiesboeck estimated the losses from this exploit at between $500 million and $1 billion. He added that the attack was timed to use a specific window before Binance implemented a promised fix.

Binance executives, Yi He and Richard Teng, apologized and promised to compensate victims who suffered losses from the USDe and BNSOL depeg.

At the same time, US President Donald Trump is also being blamed because his post on Truth Social about massive tariffs on China sparked widespread panic. This announcement about 100% tariffs starting November 1 caused the broader market crash to worsen, making it feel structural as if a large fund was forced to sell positions.

Adding to the controversy, DeFiance Capital’s Kyle shared that the Trump family-backed WLFI coin magically dropped 30% before the crash, suggesting insiders knew something and sold first. However, during the crash, WLFI was purchased by World Liberty Financial on the dip.

Also Read: Binance Announces $283M Compensation After Market Crash