Crypto ETFs Rebound as Fed Signals Possible Interest Rate Reduction

The Federal Reserve Chair, Jerome Powell, has hinted at a possible interest rate reduction before the end of 2025. This information prompted inflows into U.S. spot Bitcoin and Ether exchange-traded funds (ETFs) on Tuesday, October 14, 2025.

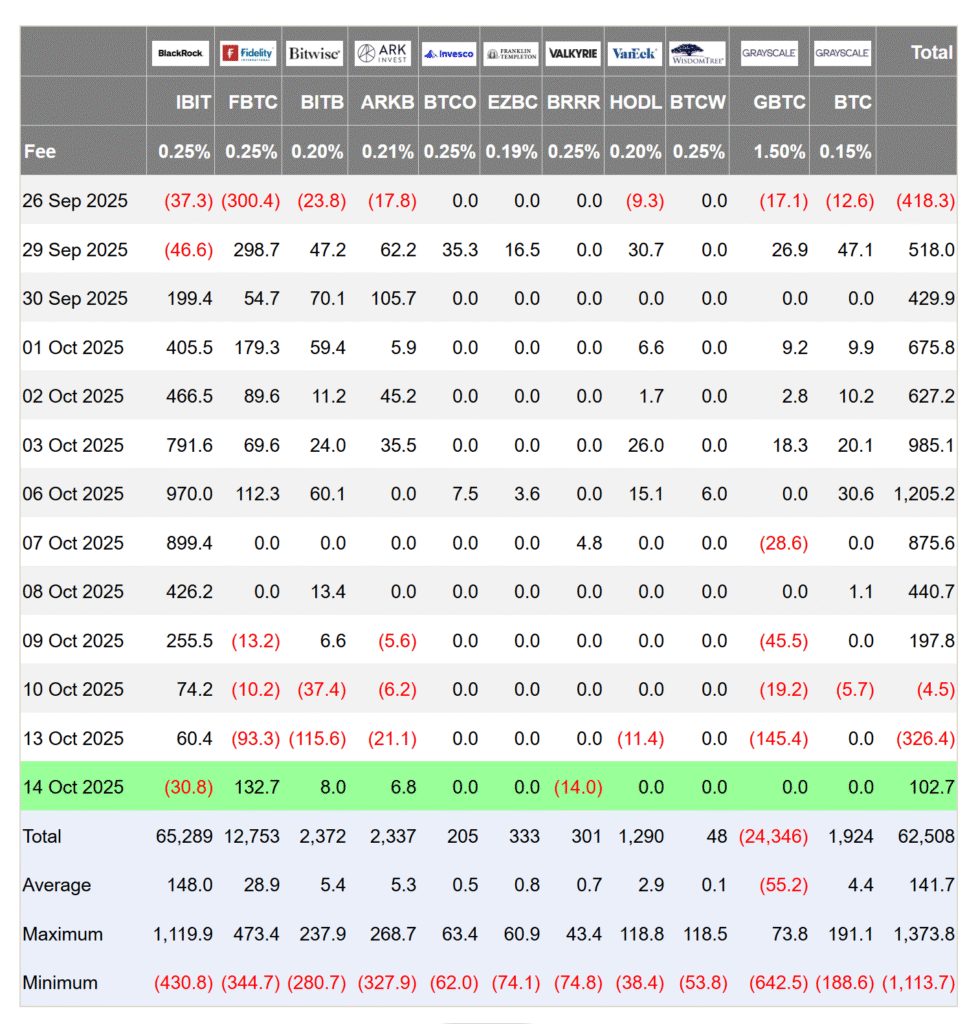

According to SoSoValue data, spot Bitcoin ETFs recorded $102.58 million in net inflows, recovering from a $326 million outflow the previous day. Similarly, Fidelity’s Wise Origin Bitcoin Fund (FBTC) led with $132.67 million in inflows, while BlackRock’s iShares Bitcoin Trust (IBIT) saw a modest $30.79 million outflow. Total assets across all spot Bitcoin ETFs rose to $154.45 billion, representing about 6.8% of Bitcoin’s total market value. Cumulative inflows now stand at $62.55 billion.

Ether ETFs followed the same direction, posting $236.22 million in net inflows after Monday’s $428 million outflow. Fidelity’s Ethereum Fund (FETH) attracted $154.62 million, followed by Grayscale’s Ethereum Fund with $34.78 million and Bitwise’s Ethereum ETF with $13.27 million.

Bitcoin ETF Flow | Source: Farside Investors

The inflows came after Powell indicated that the Fed could soon end its balance sheet reduction program and start easing policy as the job market cools. Speaking at the National Association for Business Economics conference, he said reserves are “somewhat above the level” needed to maintain adequate liquidity, suggesting that quantitative tightening could be nearing its end.

Analysts say the possibility of a rate cut could boost confidence in digital assets. According to Vincent Liu, Chief Investment Officer at Kronos Research:

“An October rate cut will have markets taking flight, with crypto and ETFs seeing liquidity flow and sharper moves,” said. He added that “Expect digital assets to feel the lift as capital seeks efficiency in a softer rate environment.”

Despite recent price swings linked to renewed U.S.-China tariff tensions, crypto investment products have remained strong. According to CoinShares, last week’s market turbulence saw $3.17 billion in inflows even as about $20 billion in positions were liquidated across exchanges.

Outflows were limited to $159 million, showing that investor sentiment stayed largely positive. So far in 2025, total inflows into crypto funds have reached $48.7 billion, already higher than last year’s figure.

Also Read: How BNB Chain Hack Triggers “4” Memecoin Surge After CZ’s Tweet