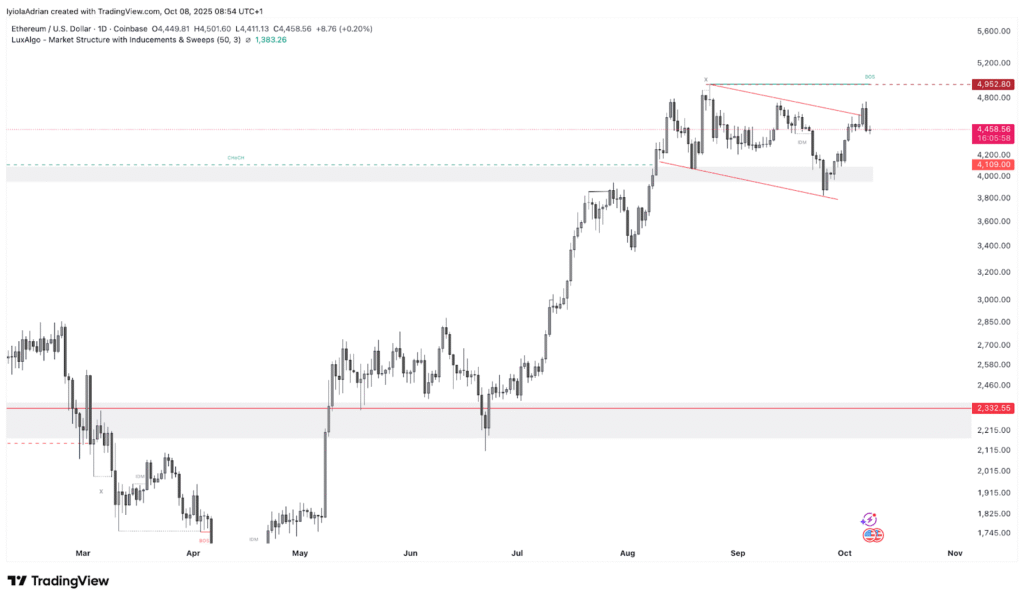

Ethereum Falls Below $4,500 After Failing to Break $4,800 Resistance

On Oct. 5, Bitcoin surged to a new all-time high, but Ether (ETH) could not break past $4,800. This caused a 3% drop below $4,500 on Tuesday.

This happened because of a bearish divergence on the four-hour chart. This usually means buyers are losing strength and a short-term price drop might happen. At the time of writing, ETH is trading for $4,463, a 4.15% drop in the last 24 hours, according to CoinMarketCap.

Ether Struggles Near Key Levels

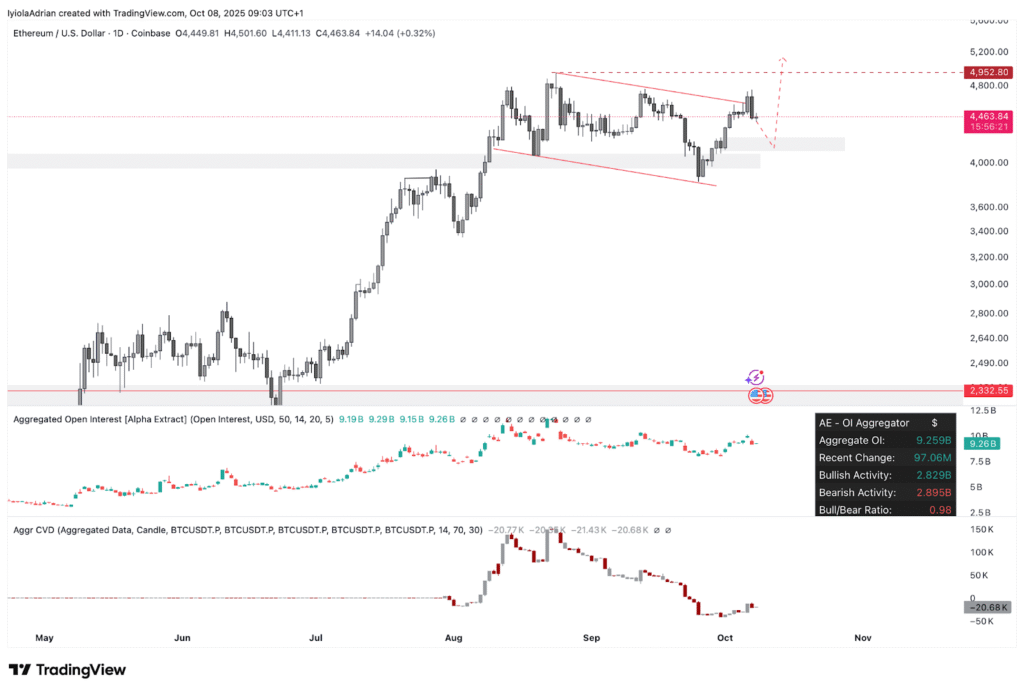

Looking at the chart via TradingView, Ether retested the $4,500 mark the same day, with data showing spot cumulative volume delta (CVD) fell sharply. This means more people were selling Ether in the spot market.

At the same time, futures open interest and futures CVD stayed high, meaning leveraged traders are still active. Analysts said this setup often attracts participants waiting for liquidity-driven entries instead of fast moves.

One important level is $4,400, where many stop orders are placed. If Ether bounces from this level, it could continue going up. But if it falls below, the price may drop further to $4,250–$4,100. These areas have a lot of past buy orders and can act as support.

Liquidity Lag and Market Moves

In a report, XWIN Research noted that Ether is showing a “liquidity lag” compared to Bitcoin. The US M2 money supply recently hit a record $22.2 trillion. Bitcoin has surged over 130% since 2022, while Ether is up only 15% in the same period.

Meanwhile, on-chain metrics suggest this could be changing. Exchange reserves for Ether fell to about 16.1 million ETH, down 25% since 2022. Net exchange flows remain negative, meaning more ETH is moving into self-custody or staking. This reduces the available supply in exchanges.

Crypto trader Skew in a statement, said the recent news was the “fourth tap” of the $4,700–$4,800 zone. He added, “If ETH manages to hold this area, that would be pretty bullish.” Traders see this as a key test for Ether’s short-term momentum. If it does not hold, the price may form a higher low and set up the next leg upward.

Also Read: Hyperliquid’s Hypurr NFTs Soar to $300M Market Cap