Forward Industries Launches $4B Plan to Expand Solana Treasury

Forward Industries has launched a $4 billion at-the-market equity program with approval from the U.S. Securities and Exchange Commission on September 16, 2025.

According to the press release, the move aims to raise capital for working funds, income assets, and Solana token purchases. The company will issue and sell shares over time, with Cantor Fitzgerald & Co. acting as the sales agent.

Chairman Kyle Samani said the program provides “a flexible and efficient mechanism to raise and methodically deploy capital in support of our Solana treasury strategy.” He added that the plan “enhances our ability to continue scaling that position, strengthen our balance sheet, and pursue growth initiatives in alignment with our long-term vision.”

Meanwhile, Forward Industries has already purchased 6.82 million Solana tokens worth nearly $1.6 billion at an average price of $232. Samani called the purchase proof of the company’s “aggressive commitment” to positioning itself as a leading Solana treasury. He noted that the new program gives the company a direct path to increase its holdings while supporting its broader corporate goals.

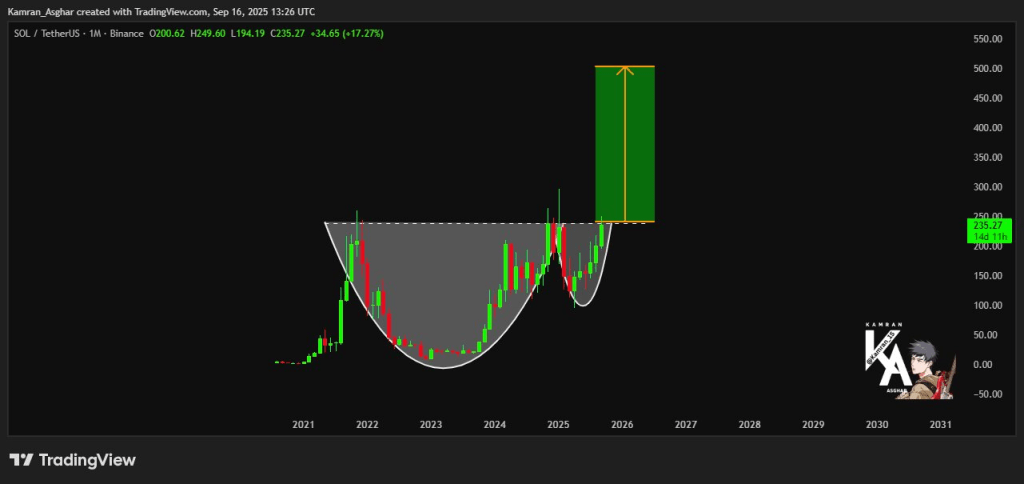

The announcement came as market watchers pointed to bullish signals on Solana’s price chart. Analyst Kamran Asghar highlighted a “cup and handle” pattern, which is often linked with strong rallies. He said a breakout above $300 could trigger a surge toward $500, supported by growing volume and demand.

SOL Market Analysis | Source: X

Notably, Solana is currently trading around $235 after reaching a recent high near $250, according to CoinMarketCap.

SOL Price action | Source: CoinMarketCap

Analysts said the token faces resistance between $270 and $300. If that level is cleared, traders expect higher targets. Despite ongoing sales from the FTX estate, which has sold about nine million tokens since November 2023, the market has absorbed the supply without losing momentum.

That said, Solana’s activity keeps rising with its total value locked reaching $13 billion. Its growth is mainly fueled by DeFi and NFTs. At the same time, the network now handles over 6 billion yearly transactions, showing rising usage.

Also Read: GD Culture Shares Drop 28% After $875M Bitcoin Deal