Hyperliquid Whale Bets $496 Million Against Bitcoin Amid Market Uncertainty

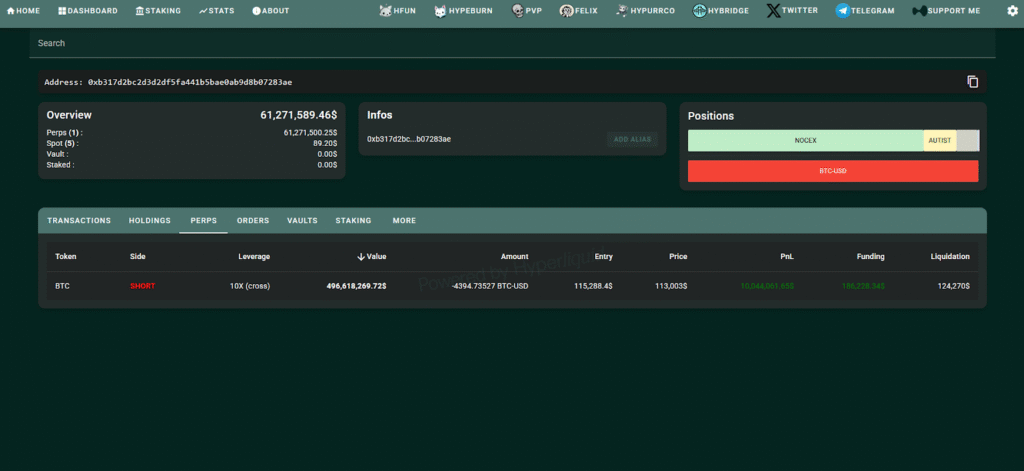

A trader on the decentralized exchange Hyperliquid has expanded their bearish bet against Bitcoin, as they increase their short position to nearly $496 million at 10x leverage, according to data from Hypurrscan.

The position has a liquidation price of $124,270, which suggest that Bitcoin, which is currently trading around $112,153, according to CoinMarketCap, will continue to decline.

The trader, widely referred to as the “insider whale,” previously made about $192 million from the recent market crash. This follows an initial $163 million short, which was more than doubled within 24 hours.

Meanwhile, onchain data shows that the whale first gained attention two months ago with an estimated $11 billion in Bitcoin holdings. More recently, the trader opened about $900 million worth of short positions on Bitcoin and Ether, continuing a pattern of large-scale trades that have positioned them prominently in the crypto space.

Moreover, the timing of the whale’s latest short has drawn speculation. The position was opened less than an hour before U.S. President Donald Trump announced new tariffs last week, Friday, the 10th of October, 2025, which led to a sharp drop in crypto prices. The coincidence has prompted questions within the community about whether the trader had prior knowledge of the announcement, reinforcing the “insider whale” label.

The individual’s identity remains unconfirmed. However, blockchain analysts have linked the wallet to Garrett Jin, the former CEO of BitForex, a now-defunct crypto exchange. The connection was first suggested by a researcher known as Eye and later reposted by Binance CEO Changpeng Zhao (CZ), who asked for clarification. Another investigator, ZachXBT, argued it could belong to one of Jin’s associates instead.

Jin appeared to acknowledge some involvement when he responded to CZ on X (formerly Twitter), stating:

“@cz_binance, thanks for sharing my personal and private information. To clarify, I have no connection with the Trump family or @DonaldJTrumpJr — this isn’t insider trading.”

In a follow-up post, Jin added, “The fund isn’t mine — it’s my clients’. We run nodes and provide in-house insights for them.”

Also Read: ‘Trump Insider Whale’ Raises Bitcoin Short to $340M