Peter Schiff Says Bitcoin is “Topping Out” Ahead of Fed Rate Cut

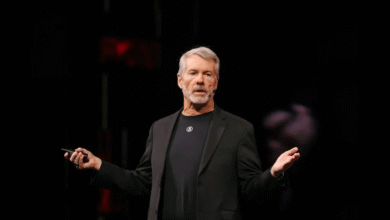

Bitcoin critic Peter Schiff said the world’s largest cryptocurrency is “topping out” just before the U.S. Federal Reserve is set to cut interest rates on September 17 at the FOMC meeting.

Over the weekend, the crypto market slowed down, and Bitcoin faced selling pressure even though it gained 4% during the week. Right now, Bitcoin is stuck under strong resistance at $114,832.

The upcoming Fed meeting is expected to bring a big change. Analysts believe that Fed Chair Jerome Powell will announce at least a 25 basis point rate cut. But Schiff disagrees with this plan. He warned that lowering rates while inflation is still high is dangerous. According to him, cutting rates at this moment will “only worsen economic risks.”

Schiff pointed out that gold and silver are doing well as safe-haven assets while Bitcoin is showing weakness. He also noted that U.S. stock markets, such as the NASDAQ and the S&P 500, have already reached record highs. Meanwhile, Bitcoin is still 15% below its all-time high from 2021. “Priced in gold should be a concern,” Schiff said. He argued that Bitcoin has failed to take advantage of the excitement around the Fed’s possible rate cut.

He also explained that while investors are buying both risky assets and safe havens, they are selling Bitcoin. After last week’s market rally, many traders are waiting on the sidelines for the next move.

Crypto market expert Ted Pillows also shared his thoughts. He said U.S. interest rate cuts are usually bad for risk assets in the short term because they often show the economy is in trouble. “They often signal underlying economic turmoil,” Pillows said. He explained that in the past, U.S. stocks often gave weak or negative returns in the three months after the first Fed rate cut.

However, Pillows added that crypto may behave differently this time. He explained that digital assets often recover before stocks do. He also said altcoins are already showing more strength than Bitcoin this September, with the altcoin season index moving higher.

Goldman Sachs expects the Fed to cut rates three times in September, October, and December, with two more cuts planned for 2026. This would lower the federal funds rate to between 3% and 3.25%.

Also Read: London Stock Exchange Launches Blockchain Platform for Private Funds