Rate Cut Hopes and US-China Talks Lift Bitcoin Price Above $110K

Bitcoin (BTC) climbed back above $111,000 at the start of the European trading session on Monday as improving global economic conditions lifted investor confidence. Data from Cointelegraph Markets showed that Bitcoin rose to $111,430, up 4% in the last 24 hours and 7.6% higher than Friday’s low of $103,530.

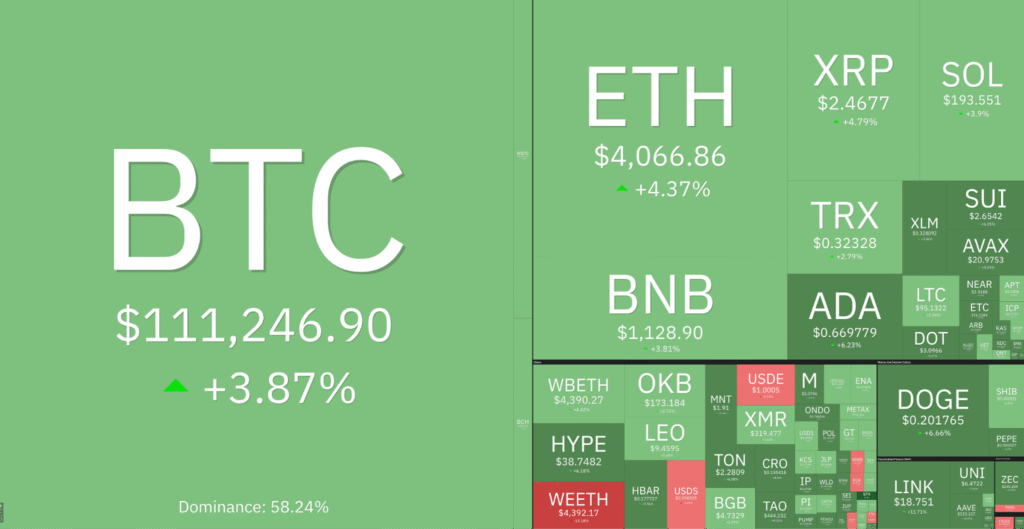

Bitcoin price trades at $111k | Source: CoinMarketCap

The recovery in Bitcoin also pushed other major cryptocurrencies higher. Ether (ETH) increased by 4.6%, returning above the $4,000 mark, while XRP, Solana (SOL), BNB, and Dogecoin (DOGE) gained between 3% and 5%. As a result, the total value of the global crypto market grew by 4.6% to $3.78 trillion.

24-hour performance of top-cap cryptocurrencies. Source: Coin360

The market’s rebound came after several positive developments in the global economy. U.S. President Donald Trump confirmed that he would meet China’s President Xi Jinping on October 31. The expected meeting eased fears of trade tension between the two countries and gave a boost to risk assets, including cryptocurrencies. Previously, Trump’s new China tariffs and growing concerns about bad loans in U.S. regional banks had weighed down the crypto market.

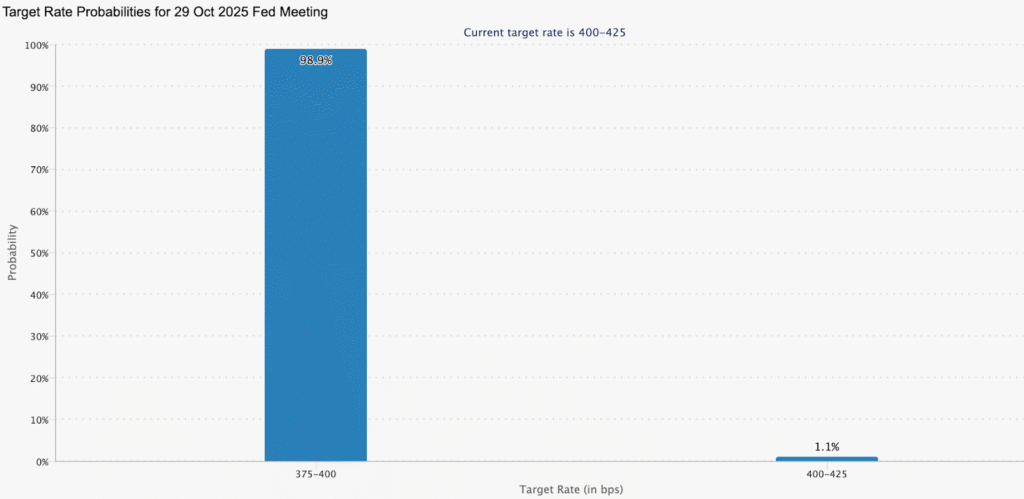

Investors are now expecting an interest rate cut from the Federal Reserve later this month. Data from the CME Group’s FedWatch tool showed a 99% chance that the Fed will reduce rates by 25 basis points at its October 28–29 meeting, bringing them to a range of 3.75%.

Target rate possibilities at the Oct. 29 FOMC meeting. Source: CME Group FedWatch tool

In addition, Fed Chair Jerome Powell recently suggested that the central bank’s tightening program might end by January 2026. Analysts say this could bring more liquidity into financial markets, similar to conditions that supported crypto growth in 2021.

Several chart patterns suggest Bitcoin could move higher, with targets between $186,000 and $192,000. Some analysts, such as Mags, believe the price could even rise toward $250,000, while others, like Aksel Kibar, expect a more moderate target of around $141,000.

Also Read: Japan to Consider Banks to Trade Bitcoin and Other Crypto Assets