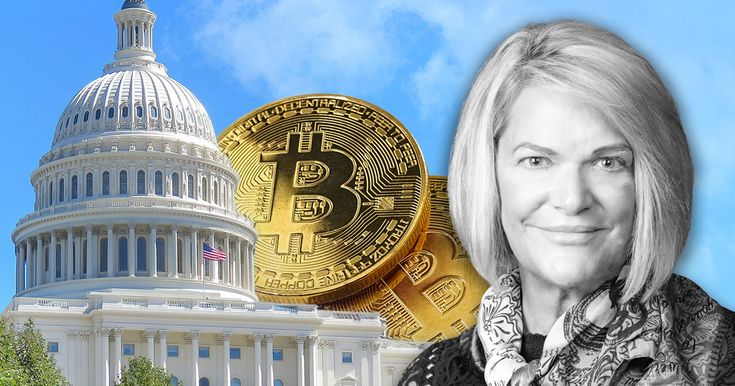

Senator Lummis Pushes Bill to Add Bitcoin to Mortgages

U.S. Senator Cynthia Lummis has introduced a new bill called the 21st Century Mortgage Act. This bill wants to let people use Bitcoin and other crypto when applying for a home loan, making sure government agencies like Fannie Mae and Freddie Mac consider digital assets when deciding if someone qualifies for a mortgage.

“We’re living in a digital age, and rather than punishing innovation, government agencies must evolve to meet the needs of a modern, forward-thinking generation,” Senator Lummis explained. This means that people who own Bitcoin or similar digital currencies could use their crypto holdings to help get a mortgage

If passed, the bill will make it illegal for lenders to force people to convert their Bitcoin or other digital coins into regular money when applying for a mortgage. This respects that digital money is a real form of wealth.

The bill follows guidance from the Federal Housing Finance Agency’s director, William Pulte, who has already pushed for digital assets to be part of mortgage assessments. Lummis’s bill would turn that guidance into law, requiring Fannie Mae and Freddie Mac to include crypto when checking someone’s loan application.

This is a big deal because Fannie Mae and Freddie Mac are run by the government and have been since 2008. They help keep the housing market steady by buying home loans from banks. Adding crypto to the loan process could change how many people get approved for mortgages.

Lately, big investors like Cathie Wood and Michael Saylor have supported the idea of using Bitcoin for mortgages. This shows that more people believe crypto can work with traditional finance.

At the time of the bill’s introduction, Bitcoin was trading near $118,000, while the total crypto market was valued at $3.85 trillion.

Besides government backing, some private companies are also starting to use crypto in loans. For example, JPMorgan lets clients use Bitcoin ETFs as loan collateral

Senator Lummis said many young people have digital money. This bill will help them use it to buy homes and build wealth in new ways.

If the bill becomes a law, it will be the first time the U.S. government would consider crypto for mortgages, marking a big step in mixing new technology with old financial rules.

Also Read: FIS Teams Up With Circle to Bring USDC to U.S. Banks