Strategy Adds 1,955 BTC Worth $217M as MSTR Stock Falls

Strategy buys 1,955 BTC for $217M, boosting holdings to 638,460 BTC, as MSTR stock slips despite Bitcoin topping $112K and missing S&P 500 entry.

Michael Saylor’s Strategy, formerly known as MicroStrategy, has purchased 1,955 Bitcoin valued at about $217 million, according to a filing with the United States Securities and Exchange Commission.

The purchase was made between September 2 and September 7 at an average price of $111,196 per coin. The company continues its streak of weekly acquisitions despite missing out on inclusion in the S&P 500 index last week.

The company revealed it used proceeds from selling stock to fund the buy. About $200.5 million came from the sale of 591,606 shares of its common stock MSTR, while another $11.6 million and $5.2 million came from two preferred stock offerings, identified as STRF and STRK.

This marked the sixth straight week that Strategy has announced a Bitcoin purchase. Only last week it acquired 4,048 Bitcoin worth $444 million.

Following the latest buy, Strategy now holds 638,460 Bitcoin in total, purchased at an average cost of $73,880 per coin. Its holdings amount to more than three percent of the total Bitcoin supply, making it the largest corporate owner of the digital asset. The company said the cumulative cost of its Bitcoin sits around $47.2 billion.

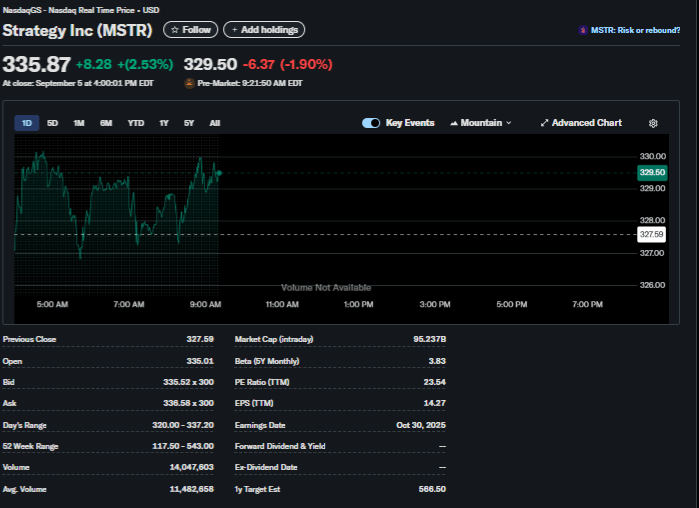

Despite Bitcoin climbing back above $112,000 on Tuesday, the company’s stock fell in premarket trading. MSTR slipped more than two percent to about $329, down from $335 at last week’s close. The decline followed the S&P 500 Committee’s decision to pass over Strategy in favor of Robinhood, AppLovin, and Emcor.

MSTR Stock price | Source: YahooFinance

Michael Saylor hinted at the new buy on Monday through a post on X. He shared a screenshot of the company’s Bitcoin tracker with the caption, “Needs More Orange,” a phrase he often uses to tease fresh acquisitions.

Strategy has been active throughout the summer with Bitcoin purchases of different sizes. It bought 31,466 Bitcoin in July, 17,075 in June, and 7,714 in August. The steady buying highlights the company’s ongoing effort to expand its holdings regardless of market setbacks.

Also Read: Metaplanet and El Salvador Buy More Bitcoin as Market Turns Neutral