Tether Reports $2.6B Profit on Bitcoin and Gold in Q2 2025

Tether has announced a $2.6 billion profit on its Bitcoin and gold holdings for the first half of 2025, according to its latest attestation report. The stablecoin issuer revealed a net profit of $4.9 billion in the second quarter alone.

The report shows that Tether holds more than 77,000 Bitcoin, worth about $9.23 billion, and over 7.66 tons of gold stored in Switzerland. Since the start of the year, Bitcoin’s value has risen by nearly 27%, while gold prices increased by 16%. These gains have helped boost Tether’s profits significantly.

In the second quarter, Tether issued $13.4 billion worth of USDT tokens. The total issuance of USDT for the year has reached $20 billion so far. The circulating supply of USDT now stands at 157 billion tokens. Tether is now one of the biggest holders of U.S. Treasury bonds, owning $127 billion in total. This includes $105.5 billion that it owns directly and $21.3 billion that it owns through other investments.

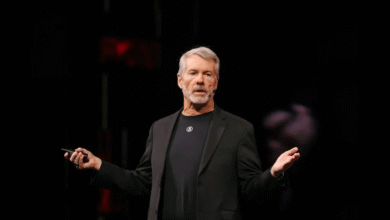

Paolo Ardoino, CEO of Tether, said, “Q2 2025 affirms what markets have been telling us all year: trust in Tether is accelerating. With over $127 billion in U.S. Treasury exposure, robust Bitcoin and gold reserves, and over $20 billion in new USDT issued, we’re not just keeping pace with global demand, we’re shaping it.”

Tether’s total assets now exceed $162 billion, while its liabilities stand at about $157 billion. The company maintains a capital buffer of around $5.47 billion, showing strong financial health and stability. This helps keep it safe from big market changes and makes sure it can keep working well.

The company is reinvesting a large part of its profits into strategic projects. This includes increasing Bitcoin holdings through its investment arm, Twenty One Capital, with plans to add 5,800 more Bitcoins. Tether is also investing in the development of the Rumble Wallet and exploring artificial intelligence innovations through Tether AI.

Additionally, Tether also plans to launch a U.S.-based stablecoin, following new rules under the GENIUS Act, aimed at strengthening the dollar’s digital future.

Also Read: Circle to Launch Native USDC on Hyperliquid with CCTP v2