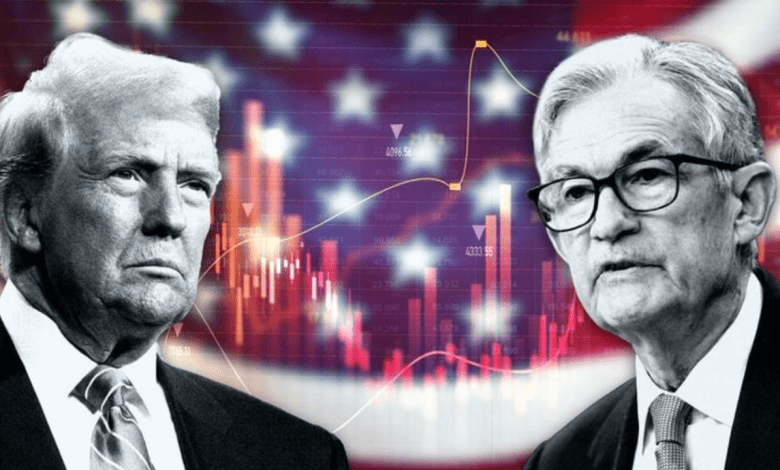

Trump Urges Fed’s Powell to Cut Rates After Strong GDP Data

Donald Trump has called on Federal Reserve Chair Jerome Powell to lower interest rates following strong economic data. On Truth Social, Trump highlighted that the U.S. economy grew by 3% in the second quarter of 2025, above the initial expectations. He said this growth, combined with lower inflation, makes it the right time for the Fed to cut rates.

Trump argued that lower interest rates would help the housing market. He said people would be able to buy homes more easily and refinance existing mortgages. The president wrote, “No Inflation! Let people buy, and refinance, their homes.” He also branded Powell “Too Late” for not cutting rates sooner.

The call for rate cuts comes just before the Federal Open Market Committee (FOMC) meeting in July. According to the CME FedWatch tool, the market odds for a rate cut at this meeting remain low, at about 3.1%, while the odds to keep rates steady between 4.25% and 4.50% fall to 96.9%. However, Treasury Secretary Scott Bessent also said he does not expect a rate cut soon.

Despite the low chance of cuts, a recent report shows that two Fed Governors appointed by Trump might push for lower rates in the near future.

Trump’s push followed a recent visit to the Federal Reserve, where he discussed the European Central Bank’s recent rate cuts and low inflation in the U.S. Trump told reporters, “I’d love him to lower interest rates,” before patting Powell on the back.

The latest GDP growth data was stronger than economists expected. Economists had forecasted a 2.3% increase, but the economy grew 3%. This rebound came after a slow start to the year when GDP contracted by 0.5%. Some of the growth was linked to changes in imports, which were affected by Trump’s trade policies.

White House Press Secretary Karoline Leavitt said, “The data is clear, and there are no more excuses; now is the time for ‘too late’ Powell to cut the rates.”

Inflation remains a concern for the Fed. Despite Trump’s claims of no price increases, inflation ticked higher in June. This is a key reason why the Fed is expected to keep rates steady for now.

Also Read: White House Releases Crypto Strategy but Omits Bitcoin Reserve