U.S. Inflation Cools to 3% as Bitcoin Tops $111K

U.S. inflation slowed more than expected in September, giving traders hope for another Federal Reserve rate cut next week. The Bureau of Labor Statistics noted that the Consumer Price Index rose 3% from a year earlier and 0.3% from August, both lower than forecast.

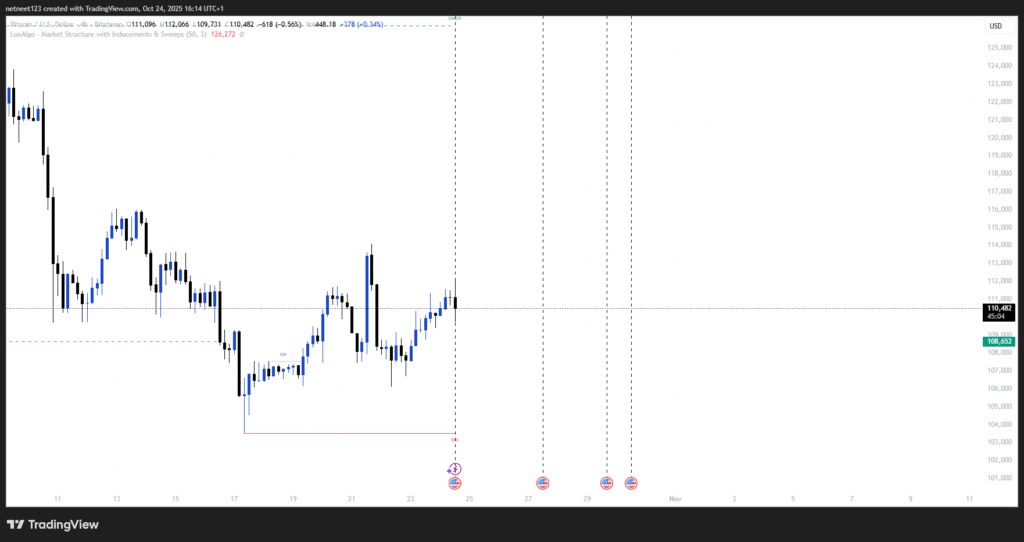

The data, delayed by the government shutdown, was released Friday in Washington. It showed core inflation, which excludes food and energy, also cooled to 3% year-on-year. As a result, investors quickly reacted as Bitcoin jumped above $111,000 right after the report.

BTC Price action | Source: Tradingview

Meanwhile, markets cheered the softer numbers, seeing them as a sign the Fed could ease rates soon. “Inflation came in softer than expected, leading to a tepid bond market rally,” said John Kerschner, global head of securitized products at Janus Henderson.

Consequently, traders are now pricing in a 99% chance of a 25 basis-point cut at next week’s meeting, according to CME FedWatch data. In addition, another 94% expect one more cut in December. Although Fed Governor Stephen Miran had called for a deeper 50-point cut, that seems unlikely for now.

Furthermore, the report showed gas prices rose 4.1% while food prices increased 0.2%. Shelter costs, which make up about a third of the index, gained only 0.2%. Electricity prices climbed 5.1% over the year, and natural gas jumped 11.7%.

Still, the slower pace overall suggests inflation pressures are easing. “This report will clearly keep the Fed on track to cut rates,” said Art Hogan, chief market strategist at B. Riley Wealth.

Afterward, stock futures rose following the data, and Treasury yields slipped. At the same time, Bitcoin led the crypto rally, hitting $111,000 as traders bet on looser monetary policy. “Inflation might not be slowing, but it’s not surprising to the upside anymore,” said David Russell of TradeStation.

Notably, the Bureau of Labor Statistics released the data despite the shutdown because the Social Security Administration uses it to adjust benefit payments. The report is the final major reading before the Fed’s next decision.

With inflation below expectations and markets on edge, investors are now watching to see how policymakers respond next week.

Also Read: Trump Pardons Former Binance CEO Changpeng Zhao