US BTC and ETH ETFs Faces Continued Outflows

US spot Bitcoin and Ethereum exchange-traded funds (ETFs) have continued to witness increased withdrawals, as investors remain stable amid the trade war between the U.S and china.

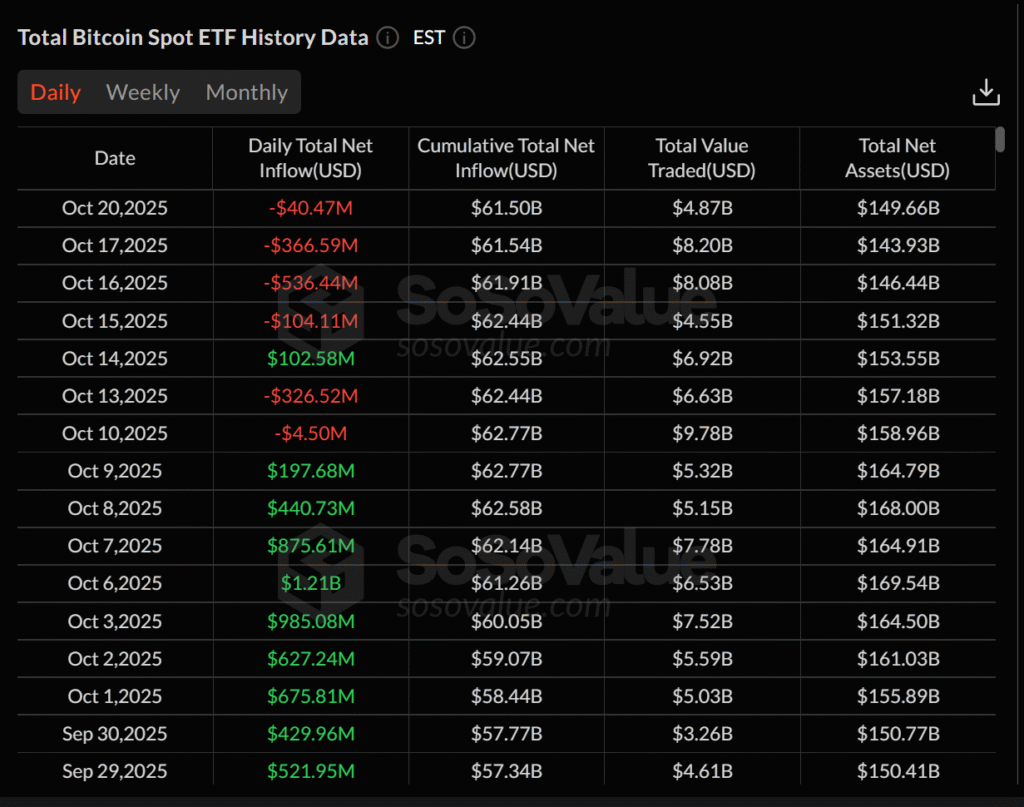

According to data from SoSoValue, spot Bitcoin ETFs recorded $40.47 million in net outflows on Monday, marking their fourth consecutive day of losses. BlackRock’s IBIT saw a decline with $100.65 million in withdrawals. In contrast, Fidelity’s FBTC and Bitwise’s BITB saw moderate inflows of $9.67 million and $12.05 million, respectively.

The total cumulative net inflows for all spot Bitcoin ETFs now stand at $61.50 billion, while total assets under management have fallen slightly to $149.66 billion, around 6.76% of Bitcoin’s market capitalization. Analysts say the consistent outflows reflect weaker market sentiment and hesitation among investors amid external pressures.

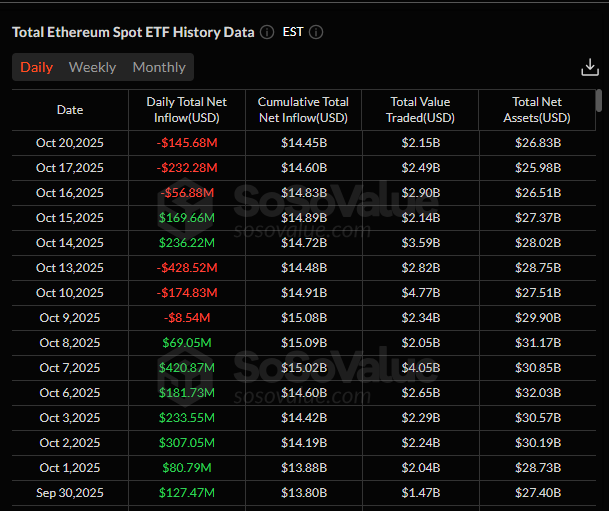

Ethereum ETFs followed a similar pattern. Spot Ether funds saw $145.68 million in net outflows on Monday, their third straight session of withdrawals. BlackRock’s ETHA recorded the highest single-day outflow at $117.86 million, followed by Fidelity’s FETH, which lost $27.82 million.

The ETF pullback coincides with rising political tension across the US. As the government shutdown reached its 18th day, large-scale “No Kings” protests erupted in several major cities, including New York, Los Angeles, and Portland. Demonstrators voiced concern over what they called a shift toward authoritarianism, with chants of “Resist Fascism” and “We the People Rule,” according to a report from Politico.

Also Read: British Columbia Bans Crypto Mining Power to Protect Hydro Power Grid