VanEck Leads New Wave of U.S. Crypto ETF Filings

A new round of crypto exchange-traded fund (ETF) applications has been submitted to the U.S. Securities and Exchange Commission (SEC) this week, despite the government shutdown, which is delaying approvals. At least five new filings were made by major issuers, including VanEck, ARK Invest, and 21Shares.

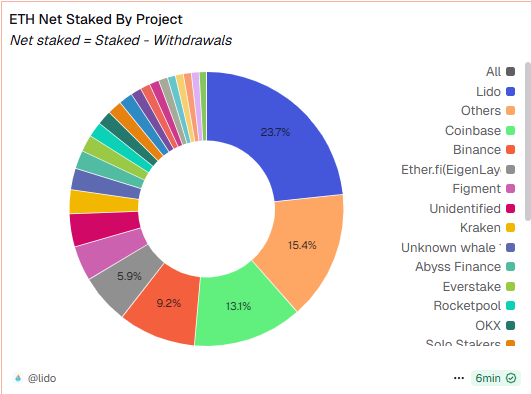

On Thursday, VanEck filed for the VanEck Lido Staked Ethereum ETF, which will track the performance of stETH, a liquid staking token issued by Lido. According to the filing, “the trust expects to accrue certain staking rewards through its ownership of stETH.” VanEck had earlier registered a statutory trust in Delaware on October 2 in preparation for the launch.

stETH represents deposited Ether (ETH) plus staking rewards, allowing investors to earn yield while keeping liquidity. Lido, is leading with around 8.5 million ETH, valued at nearly $33 billion, and offers a 3.3% staking yield.

While VanEck’s ETF focuses on staking rewards, other issuers are exploring new crypto exposure options. 21Shares filed for a 2x leveraged ETF tied to Hyperliquid’s HYPE token, giving double exposure to its single-day performance.

Bloomberg ETF analyst Eric Balchunas, in a tweet, called the filing “so niche… but then you could look up in 3-4 years it’s got a few billion,” adding that there’s a “total land rush right now” for crypto ETF products.

Cathie Wood’s ARK also joined the race with three Bitcoin ETFs. The ARK Bitcoin Yield ETF will employ yield strategies, such as selling options, to generate income. The ARK DIET Bitcoin 1 ETF offers 50% downside protection with limited upside gains, while the DIET Bitcoin 2 ETF provides 10% downside protection with higher upside potential.

Elsewhere, Volatility Shares filed for 3x and 5x leveraged ETFs linked to crypto and major U.S. stocks. VanEck also updated its Solana Staking ETF with a 0.3% fee, according to Bloomberg’s James Seyffart.

Commenting on the filings, Nate Geraci, president of The ETF Store, said, “Once [the] government shutdown ends, spot crypto ETF floodgates open. Ironic that political theater is holding these up, exactly what crypto is targeting.”

Also Read: Florida Lawmaker Revives Bill to Let State Invest in Crypto Assets