Wall Street Euphoria Rises as Crypto Markets Stay Flat

U.S. stocks are flashing strong signs of euphoria as September begins, with Bank of America’s risk-love indicator hitting a 13-month high while crypto markets remain flat. Investors are watching seasonality, jobs data, and the coming rate cut decision to see what happens next.

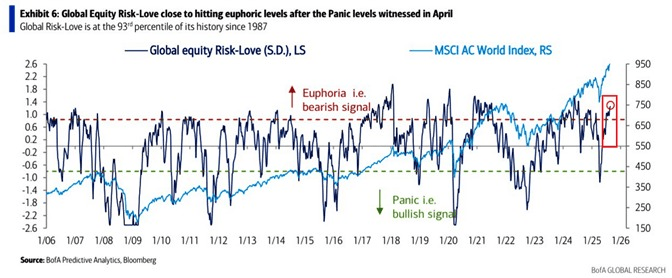

The Bank of America’s Global Equity Risk-Love indicator reached 1.4, showing a sharp rise in bullish sentiment. The Kobeissi Letter wrote in a tweet on Monday,

“BofA’s Global Equity Risk-Love indicator jumped to 1.4, its highest in 13 months. This gauge tracks investors’ positioning, put-call ratios, investor surveys, price technicals, and volatility. This metric has surged from panic levels to euphoria in just 4 months. Since 1987, sentiment has only been higher 7% of the time. These periods include the pre-pandemic rally and the post-pandemic recovery. Market sentiment is through the roof.”

Global Equiti risk Euphoria level | Source: X

Notably, both the stock and crypto markets had seen growth since April. This was supported by soft economic data and steady flows into exchange-traded funds. However, over the past week, Bitcoin was up less than one percent and Ethereum slipped 0.4 percent, according to CoinGecko.

Bank of America said in its August report that the surge in the S&P 500 and meme stocks “has been enough to raise some eyebrows.” The report added that despite this “disconnect between investor enthusiasm and fundamentals, it is not a risk that we’re overly concerned about for now.”

Meanwhile, a survey from the American Association of Individual Investors showed only 15.5 percent of respondents remained bullish, a sign that retail investors are still cautious. In crypto, the Fear and Greed Index pointed to fear as the main driver.

At the same time, analysts note that September has often been a tough month for digital assets. Data over the past 12 years shows an average loss of 3.34 percent for the month. Traders are waiting for the September 5 jobs report to set positions ahead of the Federal Reserve’s September 17 rate cut decision.

For now, stocks are high on optimism, but crypto markets are moving with hesitation.

Also Read: Metaplanet Gets Shareholder Nod for $3.7B Bitcoin Plan