Zcash Surge 153% in 7 days. What is Going on?

Zcash is trading at $138.46 today, which is a 42% surge in the last 24 hours and 153% surge in the last 7 days . This is thanks to the increase in its trading activity over the same period of time which resulted in $871.15 billion in trading volume and a market cap of $2.32 billion.

The surge started a few days ago when the price gained momentum on Sept 27 after trading sideways and consolidating between $68 resistance level and $23 support level throughout the year. However, Zcash got a push up, delivering a 233% surge in the last 10 days.

Meanwhile, Zcash has been gaining the interest of institutional players. Just recently, Grayscale posted a tweet on X stating, “@Zcash is similar to Bitcoin in its design. Zcash $ZEC was created from the original Bitcoin code base, but it uses a privacy technology that encrypts transaction information and allows users to shield their assets. Grayscale Zcash Trust is open for private placement for eligible accredited investors.”

Adding to this, AngelList co-founder Naval Ravikant showed a strong opinion about the token stating, “Bitcoin is insurance against fiat. ZCash is insurance against Bitcoin.” These tweets seem to have created a frenzy for the token.

Looking Forward

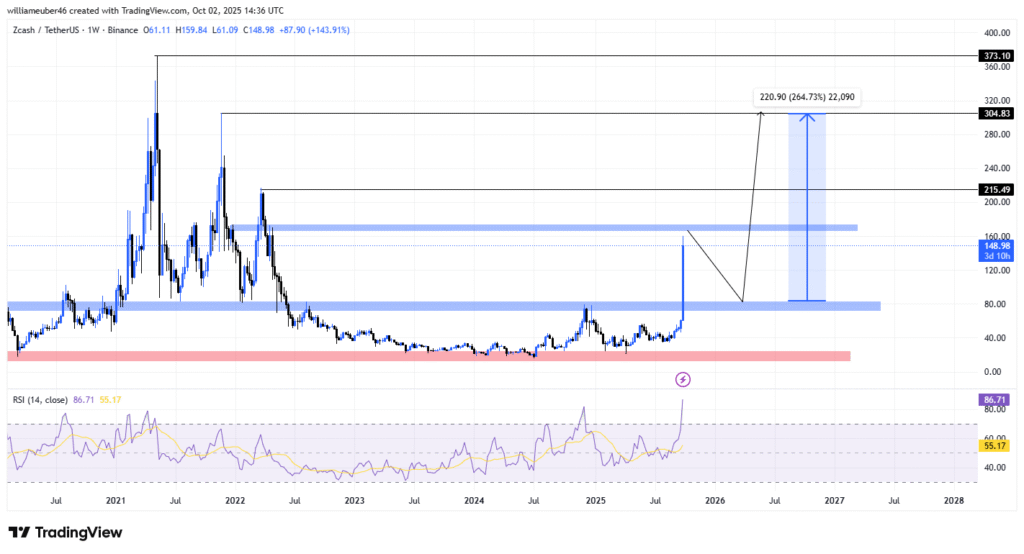

Going forward, the market prints a three-way scenario. Looking at the momentum that has given a 42% in just 24h suggests that the buying pressure could break past the 215.49 level, heading towards its all-time high of $373.

However, adding confluences like the RSI, which is used to monitor the momentum of the market, gives a second scenario. The RSI shows that price is sitting at the 86.42 level, which suggests that the market is overbought. This also means that the market might slow down to retest the $83.69 support level before pushing to $304, which is another 264% increase in price.

Lastly, if the market is to trade below the $83.69 support level, then a retest of the $25.12 resistance level is imminent.

Also Read: BlackRock Files Nasdaq Bitcoin Premium Income ETF with SEC